You know why I chart bitcoin

1, Charting bitcoin and try to think where its going then bet on altcoins instead of longing BTC itself and you are free from getting stop hunts by the market/exchanges/whales/bots/other sophisticated traders. (don't want to name who are behind the wickes/stop hunts but they do exist so, we don't care about who do that, your job is to avoid it)

2, bitcoin somehow has the lowest utility, the only utility (for now, vast majority) is for speculating/gambling, unless your life doesn't depend on btc's price, you buy and don't touch till something like 2+ years, yet it still has significant impact on almost entire market.

Bitcoin is the trendsetter.

Because

If Bitcoin goes up and altusd is not up while altbtc is down, altusd will eventually catch up. (unless you buy the lowest quality shitcoin that nobody wants to buy, from left curve people to right curve people)

and

If Bitcoin goes down while altusd pumping, altusd will eventually go down.

So if you think of altcoin as a derivative of Bitcoin:

buy alt = long bitcoin (depends on correlation, assuming for every 5% btc move, large cap alts move 10-15%, so if you buy $10k worth of altcoin instead of bitcoin that's pretty much like longing btc x1.15 without potential risk of margin call. less mental pressure).

So when btc rallies and alt pumps hard as the same time that is quite like people ape in long a lot, derivatives market heats up, this does not necessarily mean its risky and market going to dump soon, but it potentially means the pump won't be around for too long.

Bitcoin used to rule the alt-market a lot, it's still relevant now but a bit less. Compared to altcoins, what can we do with bitcoin? we can't farm like defi coins, can't vote like DAO coins, can't have fun like meme coins, can't ...entertain like gamefi coins, can't be widely used as payment like ...stable coins. It's like hard asset, pretty much like gold, you have some gold bars at home, can't do nothing about it but holding and sell someday if you want to, while some other people have jewelries with gold. So bitcoin is similar in the sense that if you believe in bitcoin's value not being depreciated over time (and can beat inflation regardless, if it can't, you simply just hold cash or fiat), you simply hold it (holder/investor) or you can trade it to gain more of them (trader/speculator). Bitcoin being used as payment does not add any value to bitcoin's price, since merchant who accepts it can just sell it back into fiat, if they decide to hold then it comes back to the story of being 'holder' or 'speculator'. The other group of people are those who put bitcoin as collateral, to borrow against it, you can group them either way because they reduce sell pressure but on the other hand, they also add more risk if btc's price moves downward.

So speaking of utility and btc vs. alt stuff, it's hard to explain why btc still matters, the most common answer would be big money will enter through btc first (maybe also eth) because they are liquid and less volatile as well, after that, bitcoin holders/traders who got better entry, after holding bitcoin through waves, decide to rotate into alts, then alts pump hard. The market at this phase turns into a musical chair game, music can stop whenever and you have the risk of landing on floor, because there are new alts everyday, if a good coin invented, there are hundred of forks or copycats ready to to be deployed and attracted normie's money.

Maybe one day in future, bitcoin will have zero impact on alts, that is just a possibility, I am not trying to claim nothing but one thing I believe that it won't happen in 4-5 years or anytime soon.

Ok, so why do I ramble too much about this stuff because you see, I read bunch of altcoin tech stuff and always post bitcoin charts. I simply make my own prediction on bitcoin and make my bets on alts, unless I figure out something like what happened in second half of 2020, I will buy bitcoin instead of alts. Therefore, there are two important things to do:

- Try to predict bitcoin direction.

- And try to pick the strongest alt if btc bounces.

ok so here are the charts:

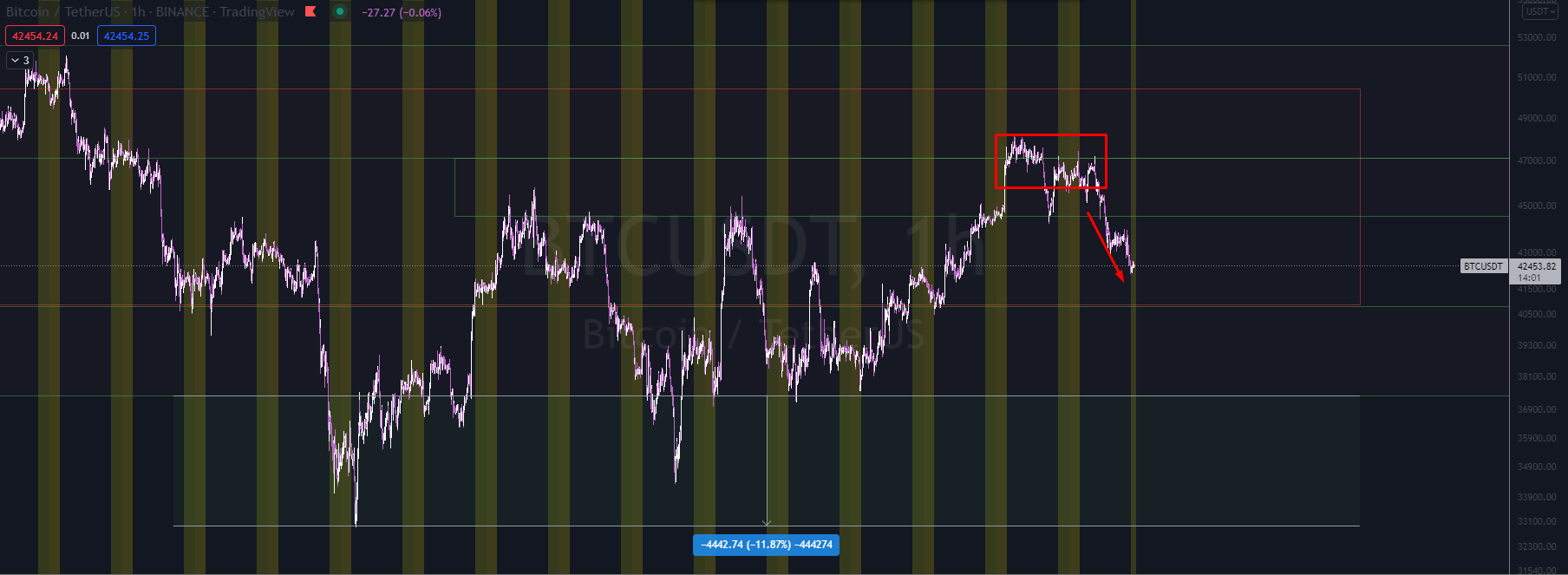

this was back in June-July 2021:

This time it reacts quite similar to the one above: deviation above previous highs, comes back into ranges, top in the beginning of the week and sell-offs following towards before Friday's close. (yellow vertial lines are weekends, ranges in-between are weekdays). So, the last time it was sold off for two weeks, local bottom on the second week followed by a low volatility rally then slow bleed towards previous low, this marks the pico bottom.

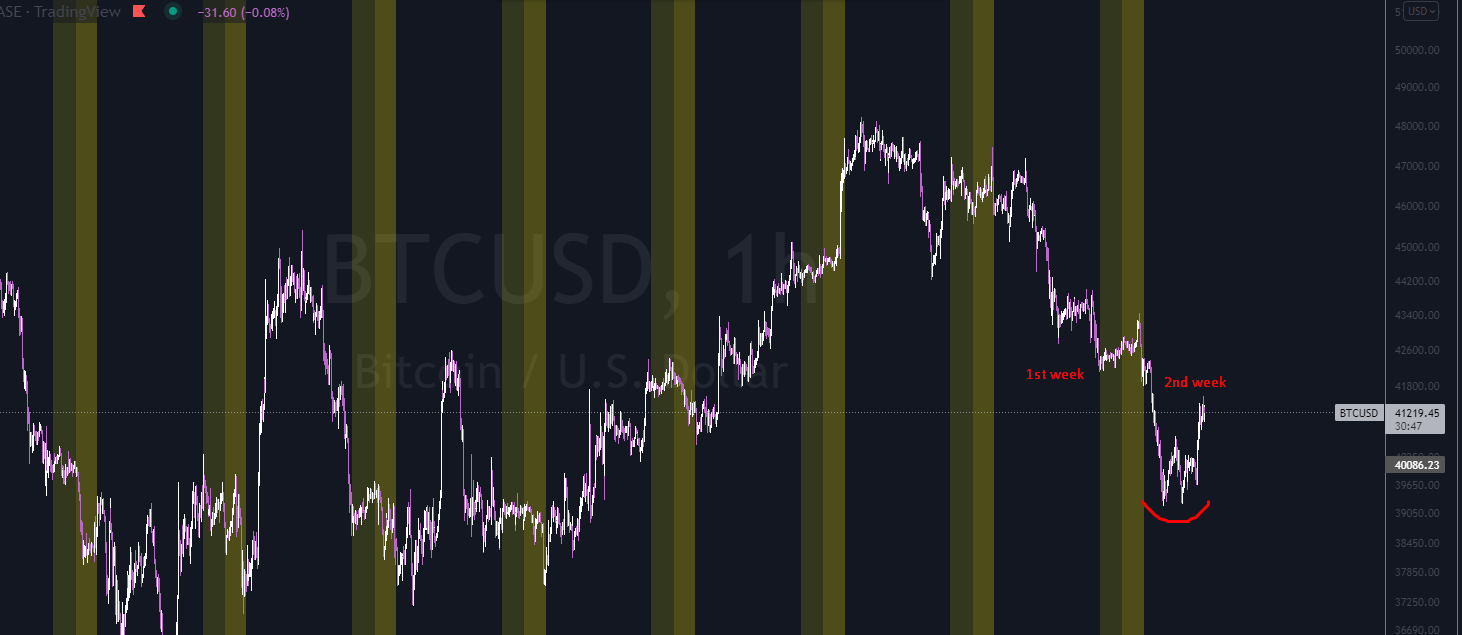

This is where it is now(I captured the one above last week but didn't have time to finish this article, I was wrong for being bullish in last report though):

So, there is decent chance that this will keep volatile at range high for 2 weeks like what it did last time before bleeding into range low or breaking down to new lows if no key level was broken upward.

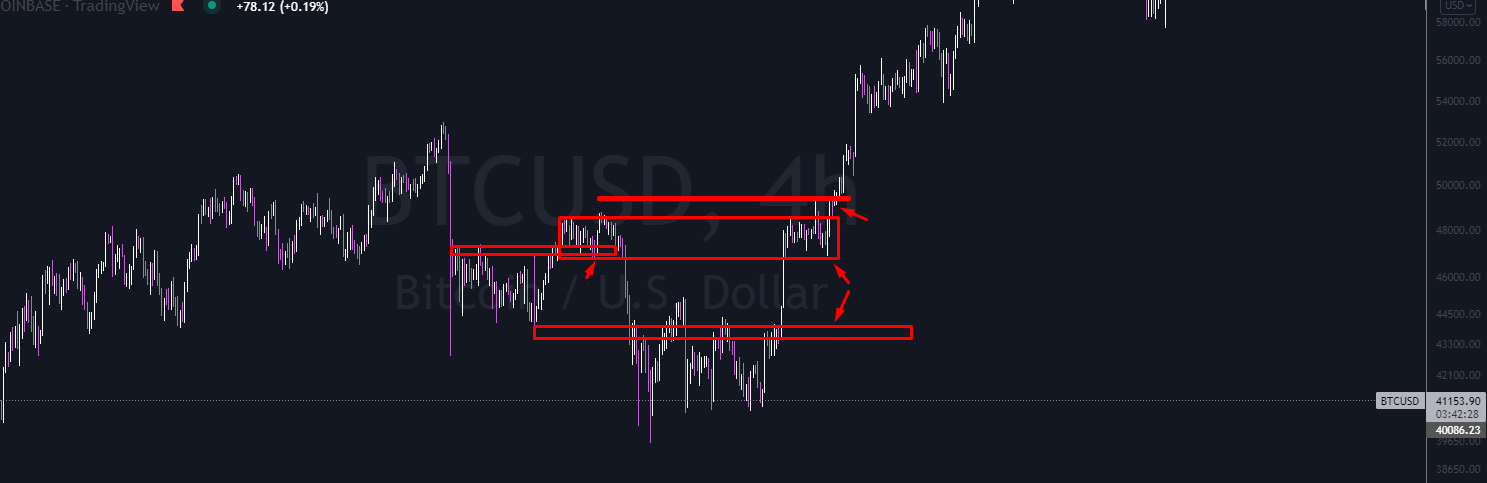

Okay, now zoom in and look at what kind of bottom it has printed:

the other similar ones that I have found:

1, bullish one:

Strong buy pressure, bitcoin got right into previous imbalance area, gave no retest to range high of bottom's range, left a big gap => continuation.

2, bearish one:

Got some strength at first but struggle at the imbalance range above, lean toward bottom's range high, then broke down.

Same as above, move toward bottom's range high, broke down.

Some people even compare to the covid crash, assuming we are on the same liquidity risk as we did back then, that red square I highlighted on the right is big red flag: price went flat struggling to reclaim the previous S/R flip (9k4), extremely low volatility after a relief bounce meaning somebody bought the dip but there is no buys follows through, market is so illiquid and price is nowhere close to the previous range where whale and MM dumped their first batch, MMs sensed the risk here and unloaded their inventory afterward.

So if bitcoin sideways with extremely low volatility here, it's red flag.

Another bearish one:

See the arrow, price coming back to previous bottom's range high => breakdown.

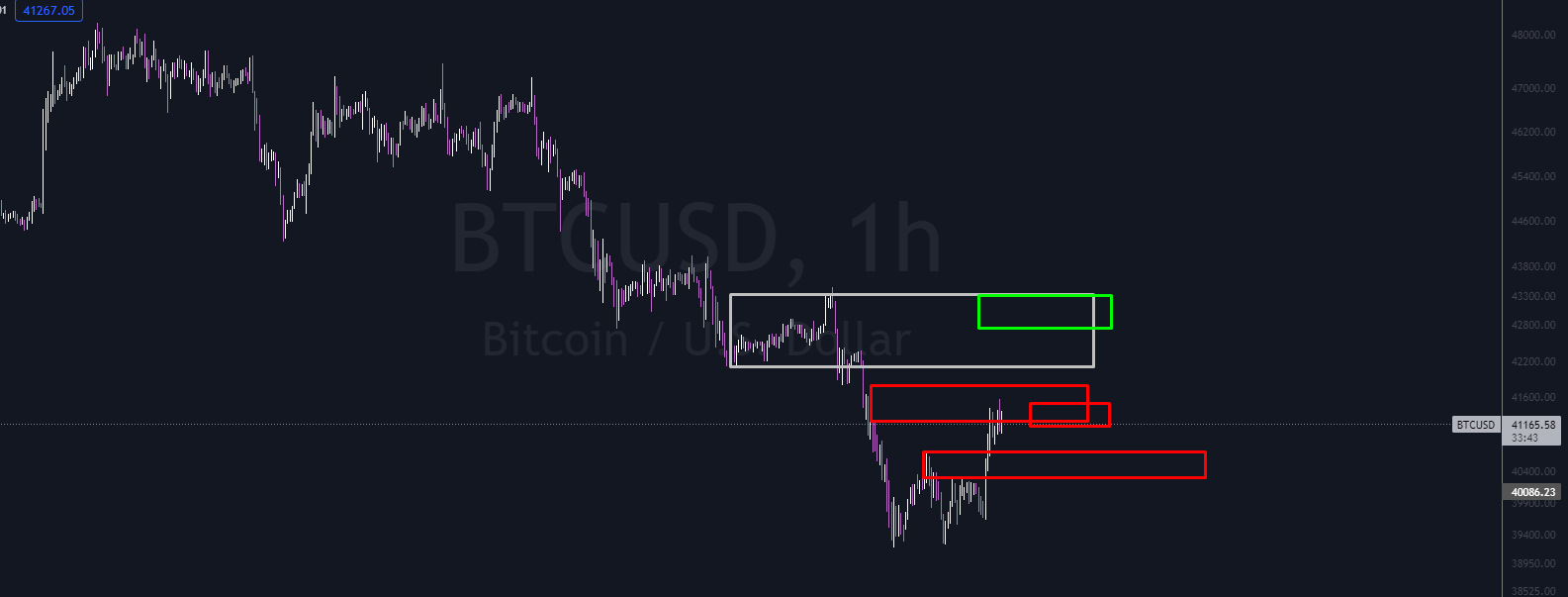

For now, bitcoin still fluctuates within 41kxxx zone, you can do all the TA works to fomo any alts you want IF you want to risk on, your invalidation is the bottom square, if bitcoin manages to get in white square and leans toward green box, it's really bullish.

Basically, there is a bull flag right now and the first resistance is something around 42k, I expect a strong green candle to crush through it, if it roundtrip back down, I'll run.